Abstract Ventures

Seed-focused fund in San Francisco. Lead software development of a proprietary data platform.

Will Thomsen

Venture capital product lead and alternative data engineer.

Partner at Abstract Ventures where I bring data-driven decision making to the archaic venture capital stack. Architect and engineer of a proprietary altenative data solution. Previous stops include VC, investment banking and as technical co-founder of a fintech startup.

Seed-focused fund in San Francisco. Lead software development of a proprietary data platform.

Seed and Series A investments focused on financial innovation. On a mission to create upward mobility by saving people time and money.

No-code solution for personal finance. Connected users to their finances through user-generated trigger & action workflows.

Niche travel aggregator for Las Vegas. Dorm room project that kept going for 10 years. Found an edge combining UGC-driven discovery with best-in-class scraping and savvy longtail SEO.

Investment banking in the Financial Institutions Group during the financial crisis. M&A, capital raising and restructuring transactions. Lots of VBA.

Four years (undergrad) with the Management and Organizations Department at Kellogg. Among many research-assisting roles, led full stack development of online experiments.

Always exploring the new thing through code.

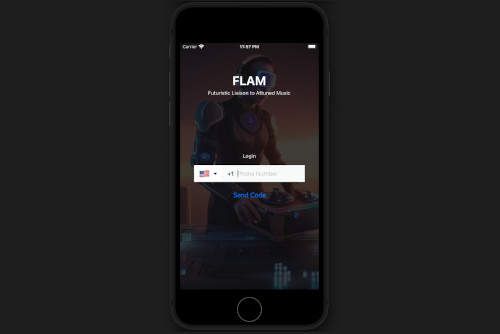

Your AI DJ. Uses OpenAI to generate and load prompt-driven playlists across music streaming services. (React Native, Supabase, SST)

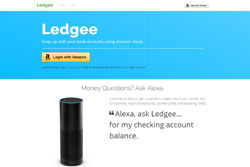

NLP chatbot for banking combining bank accounts (via Plaid) with voice intents. Cross-platform architecture supported Alexa, SMS and Messenger.

Bringing interactive gaming to the Chromecast. 250,000+ installs, 80k MAU. Large developer ecosystem used the game’s public API.

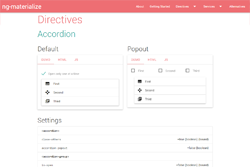

Web component library for Angular based on Material Design 1.

Programmatic access to EmailOctopus. Dramatically reduced newsletter costs with AWS SES.

Multiplayer game for Google Chromecast. Great for training basic strategy and counting/advantage play. (15,000+ users).

Hacking on an early stage startup or venture capital innovation? Reach out.